Medicare Part D Formularies: How Generic Coverage Works in 2025

By 2025, Medicare Part D is helping over 51 million seniors and people with disabilities get affordable prescriptions - and most of those prescriptions are generics. If you’re taking pills for high blood pressure, diabetes, or cholesterol, chances are you’re on a generic drug. But knowing how your plan covers them isn’t always simple. Here’s how generic coverage actually works under Medicare Part D today - no jargon, no fluff.

What Is a Medicare Part D Formulary?

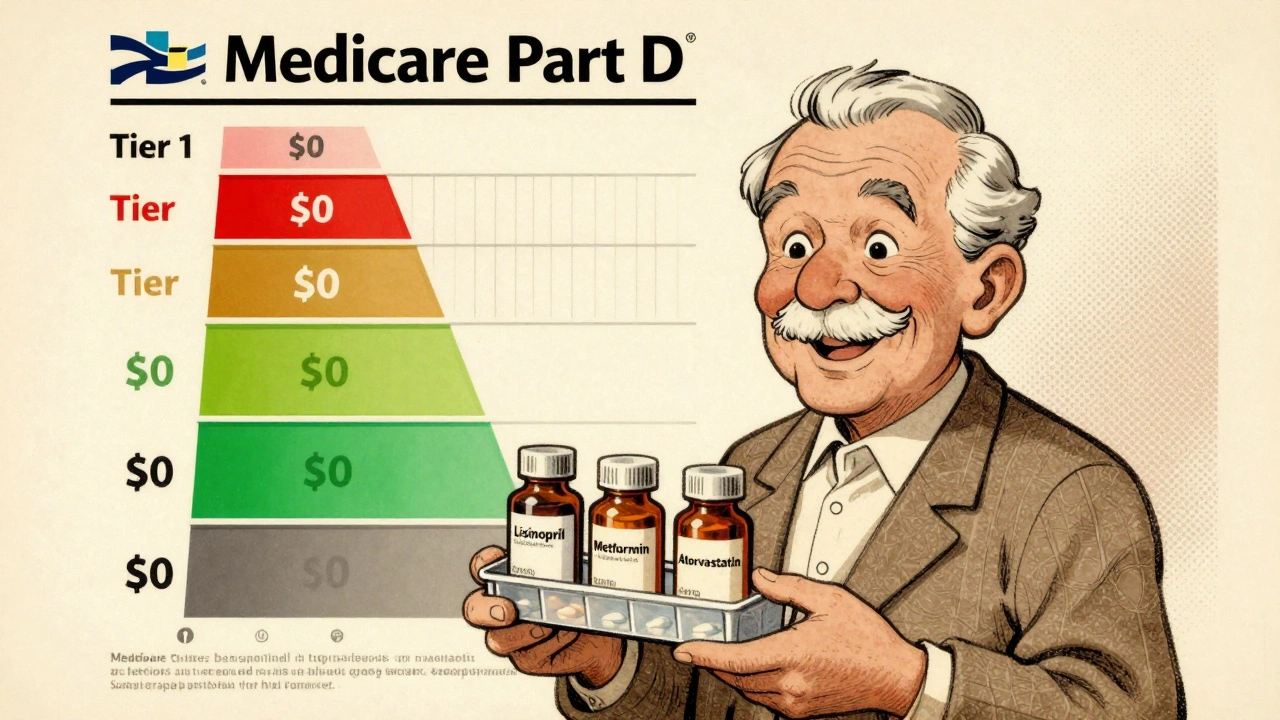

A formulary is just a list of drugs your plan will pay for. Every Medicare Part D plan has one, and it’s not the same across plans. Some cover certain generic versions of a drug, others don’t. The government requires plans to cover at least two different generic drugs in each major drug category - like blood pressure or antidepressants - so you’re not stuck with just one option. But that doesn’t mean you’ll get every generic out there.Formularies are split into five tiers. Generics live mostly in Tier 1 and Tier 2. Tier 1 is where you’ll find the cheapest generics - often $0 to $15 for a 30-day supply. Tier 2 is for generics that aren’t preferred, meaning they might cost more - maybe $20 to $40, or you pay a percentage of the price. Higher tiers (3 to 5) are for brand-name and specialty drugs, which cost way more.

How Much Do You Pay for Generics in 2025?

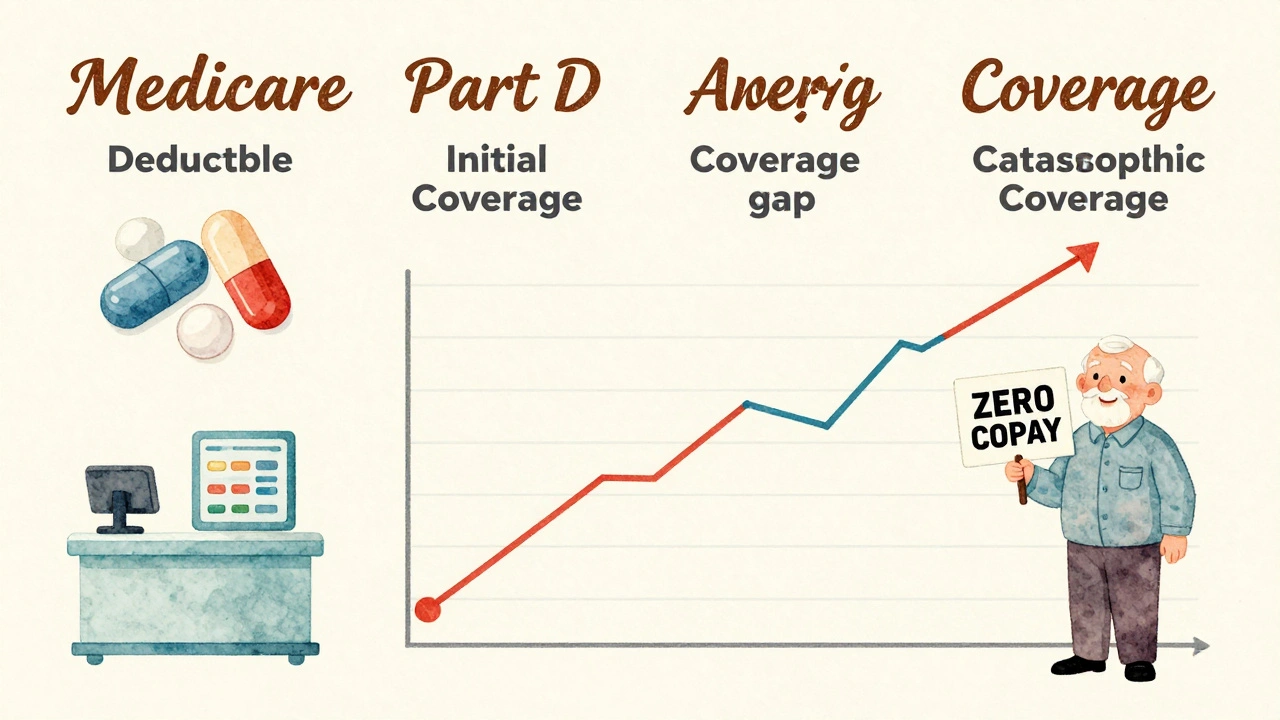

Your out-of-pocket cost depends on what phase of coverage you’re in. In 2025, you first pay a deductible of $615. After that, you enter the initial coverage phase. Here’s the key: for generic drugs, you pay 25% of the cost. The plan pays the rest.Let’s say your generic blood pressure pill costs $30. You pay $7.50. The plan pays $22.50. That’s it. But here’s what most people don’t realize: only the money you pay counts toward your out-of-pocket limit. For brand-name drugs, a chunk of the manufacturer discount counts too - but not for generics. So if you’re on multiple generics, every dollar you pay out of pocket adds up.

Once you hit $2,000 in out-of-pocket spending in 2025, you enter catastrophic coverage. That’s the big change from the Inflation Reduction Act. After that, you pay nothing for your generics for the rest of the year. No more coinsurance. No more copays. Just walk up to the pharmacy and get your pills.

Why Do Plans Care So Much About Generics?

Because they save money - for everyone. In 2023, 92% of all prescriptions filled under Part D were generics. But those generics made up only 18% of total drug spending. That’s the power of generics. A pill that costs $200 as a brand name might cost $4 as a generic. Plans push you toward those cheaper options because it keeps premiums lower and the system running.Each plan has a Pharmacy and Therapeutics (P&T) Committee - made up of doctors and pharmacists - that decides which generics to include. They look at safety, effectiveness, and price. If a new generic hits the market and is cheaper than what’s already on the formulary, the plan might swap it out. That’s why you need to check your formulary every fall.

What Happens When Your Generic Isn’t Covered?

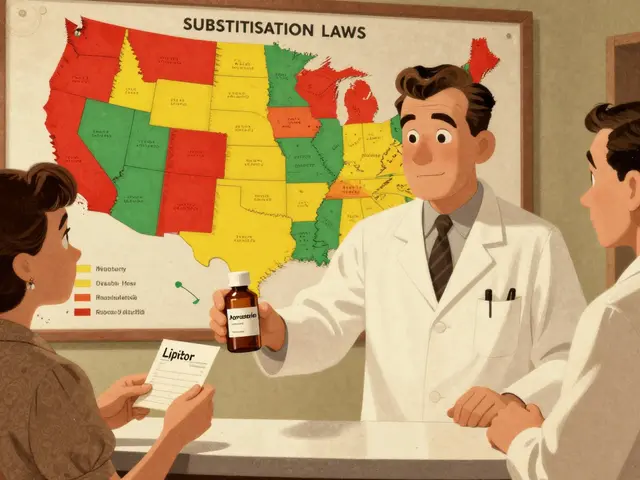

This is where things get messy. Let’s say you’ve been taking a generic version of lisinopril - a common blood pressure drug. Your plan covers one brand of it, but not another. The pharmacist tries to substitute the one your plan likes, but you’ve been on the other for years and your body reacts better. Now you’re stuck paying full price.That’s called a therapeutic interchange. It’s legal, but it can cause real problems. In 2024, 23% of all Part D complaints were about generic substitution issues. You might think all generics for the same drug are the same - but they’re not always. Some have different fillers or coatings that affect how your body absorbs them.

If your generic isn’t covered, you can ask for a coverage determination. You submit a request to your plan saying why you need this specific drug. In 2023, 83% of these requests were approved. Don’t assume it’s a no - fight for it.

How to Pick the Best Plan for Your Generics

Not all Part D plans are created equal. Two plans might both cover lisinopril, but one puts it on Tier 1 ($0 copay) and the other on Tier 2 ($30 copay). That’s a $360 difference a year. Here’s how to find the right plan:- Make a list of every generic drug you take - including dosage.

- Go to the Medicare Plan Finder tool. Enter your zip code and your medications.

- Sort by “lowest total annual cost” - not just monthly premium.

- Check the formulary for each plan. Make sure your exact drug names are listed.

- Look for plans with $0 deductible - 52% of stand-alone Part D plans offer this in 2025.

KFF found that people who use this tool save an average of $427 a year. That’s not a small amount. And if you’re on three or more generics, even a $5 difference per pill adds up fast.

What’s Changing in 2025 and Beyond?

The Inflation Reduction Act didn’t just cap your out-of-pocket costs - it’s reshaping the whole system.- Starting in 2026, plans must include a generic price comparison tool in their member portals. You’ll be able to see which version of your drug costs the least.

- In 2029, Medicare will start negotiating prices for some generics. Insulin glargine is already on the list - meaning its generic version could drop in price dramatically.

- By 2027, 95% of beneficiaries will have access to $0 copays for at least half of commonly used generics, up from 78% today.

These changes are pushing plans to compete harder on price. More plans are offering $0 generics to attract members. That’s good news for you.

Real Stories, Real Savings

One user on Reddit, ‘SmartSenior2024’, said: “My three generic heart medications cost me $0 under my Plan D’s Tier 1 coverage - I save over $300 monthly compared to what I paid before Medicare.”Another, ‘MedicareVeteran82’, wasn’t so lucky: “My plan only covers one generic blood pressure pill. The one my doctor prescribed? Not covered. I had to pay $80 a month out of pocket until I switched plans.”

That’s the difference between doing your homework and assuming your plan is good enough. Satisfaction is high among generic users - 87% report being happy with their coverage. But only if they know how to navigate the system.

What You Need to Do Now

December is Open Enrollment. That’s your chance to switch plans. Don’t wait until you need a refill.- Read your Annual Notice of Change (ANOC). It comes in the mail every fall. Look for changes to your drugs’ tiers or copays.

- Call your pharmacy. Ask: “Is my generic still covered on Tier 1?”

- If you’re on multiple generics, look for a plan with a $0 deductible and low copays.

- If a drug you need isn’t covered, file a coverage determination. You have rights.

You don’t need to be an expert. But you do need to be informed. Medicare Part D was built to help you save money - especially on generics. The system works, but only if you use it right.

Are all generic drugs the same under Medicare Part D?

No. While generics have the same active ingredient as brand-name drugs, they can differ in inactive ingredients, shape, or how they’re absorbed. Medicare plans often cover only one or two generics per drug class. If your plan covers a different generic than the one your doctor prescribed, you might pay more or get a drug that doesn’t work as well for you.

Why do some generic drugs cost more than others?

It’s all about the tier. Tier 1 generics are preferred - usually cheaper and covered with a low copay. Tier 2 generics are non-preferred and cost more because the plan wants you to use the cheaper version. Sometimes, a higher-cost generic is newer or has fewer competitors, so the plan doesn’t have much leverage to negotiate a lower price.

Can I switch plans if my generic gets removed from the formulary?

Yes. If your plan removes a drug from its formulary, you can switch to another Part D plan during a Special Enrollment Period. You don’t have to wait for Open Enrollment. Just make sure the new plan covers your drug before you switch.

Does the $2,000 out-of-pocket cap include what I pay for generics?

Yes. Every dollar you pay for generics counts toward your $2,000 out-of-pocket limit in 2025. Once you hit that limit, you enter catastrophic coverage and pay $0 for all covered drugs - including generics - for the rest of the year.

What if my doctor prescribes a brand-name drug but a generic is available?

Your pharmacist can usually substitute a generic unless your doctor writes “Dispense as Written” on the prescription. If you’re okay with the generic, let the pharmacist switch it - you’ll save money. If you need the brand, ask your doctor to write that note on the script. Your plan will still cover it, but you’ll pay more.

9 Comments

Chelsea Moore

December 2, 2025 at 11:08

Ugh. I can't believe people still think 'all generics are the same'! My cousin had a stroke because her plan swapped her lisinopril for a 'bioequivalent' that had a different filler-her body rejected it like it was poison. 🤮 And now they want us to trust these corporate formularies? NO. NO. NO. This isn't healthcare-it's a casino where your pills are the dice.

ruiqing Jane

December 4, 2025 at 05:58

I want to thank you for writing this with such clarity. So many people are terrified of Medicare Part D because it feels like a maze-but you broke it down like a lifeline. I’ve been helping my mom navigate her formulary since January, and knowing that generics count fully toward the $2,000 cap was a game-changer. She’s now on a $0 deductible plan and pays $3 for her metformin. Small wins matter.

Fern Marder

December 6, 2025 at 05:45

Just switched plans last week 😌 Tier 1 = $0 for all 4 of my meds. Life is good. 🙌 Don’t overthink it-use the Plan Finder. It’s free. Your future self will high-five you.

Carolyn Woodard

December 6, 2025 at 14:56

The epistemological tension here is fascinating: if a generic drug is pharmacologically equivalent but pharmacokinetically distinct due to excipient variance, does the state’s mandate of 'therapeutic equivalence' constitute a performative illusion of equivalence? And if the P&T committee prioritizes cost over individual bioavailability, are we not commodifying physiological subjectivity under the guise of systemic efficiency? I ask not to provoke, but to sit with the discomfort.

Allan maniero

December 7, 2025 at 10:27

I’ve been on Medicare Part D for six years now, and I’ve learned one thing: the system works if you’re willing to put in the five minutes. I used to just take whatever the pharmacy gave me. Then I started checking the formulary every October. Now I save over $500 a year. It’s not glamorous, but it’s real. And honestly? That’s the whole point. No drama, no hype-just showing up for yourself.

Elizabeth Farrell

December 8, 2025 at 00:44

I know this sounds boring, but please, if you’re on more than two meds, sit down with a cup of tea and go to Medicare.gov. Seriously. I used to think my plan was fine-until I found out my plan had swapped my generic amlodipine for one I couldn’t tolerate. I didn’t know until I got the ANOC. Don’t be like me. Do the work. It’s not hard. Just slow. And it saves you thousands.

Sheryl Lynn

December 9, 2025 at 18:45

Ah yes, the great American pharmaceutical farce. You’ve cleverly dressed up corporate cost-shifting as 'patient empowerment.' Let’s be honest: these formularies are designed to funnel patients toward the cheapest generic, regardless of whether it's the right one. The 'catastrophic coverage' cap? A PR stunt. The real winners are the PBMs who pocket the rebates. You’re not saving money-you’re just being redirected to a cheaper corner of the same pyramid scheme.

Anthony Breakspear

December 10, 2025 at 15:45

Look, I get it-generics are the unsung heroes of Medicare. But here’s the truth: if your plan drops your generic mid-year and you’re stuck paying $80 a month, that’s not a glitch-it’s a feature. The system’s rigged to make you jump through hoops. But guess what? You’ve got rights. File that coverage determination. Call your pharmacist and say, 'I’m not moving off this pill.' Most of the time, they’ll bend. And if they don’t? Switch plans. Don’t be a martyr. Your health isn’t a negotiation.

Paul Santos

December 11, 2025 at 11:24

Ah, the sacred ritual of Open Enrollment. 🤓 Where we, the humble beneficiaries, are expected to become pharmacoeconomic analysts overnight. The irony? The very people who designed this labyrinth don’t even understand it. And yet-we’re told to 'be informed.' Meanwhile, the PBM executives are sipping champagne on a yacht in Monaco. I’m not angry. I’m just… disappointed. And mildly amused. 😅