Non-formulary generics: what to do when coverage is denied

When your doctor prescribes a generic medication and the pharmacy says it’s not covered, it’s not a mistake - it’s a non-formulary generic. These are FDA-approved, low-cost versions of brand-name drugs that your insurance plan simply doesn’t list on its approved drug list. Even though they’re chemically identical to the formulary versions, your plan may deny coverage for reasons like cost negotiations, preferred manufacturer deals, or arbitrary tiering rules. The result? You’re stuck paying full price - sometimes hundreds of dollars more - for a drug that should be affordable.

Why are generic drugs left off the formulary?

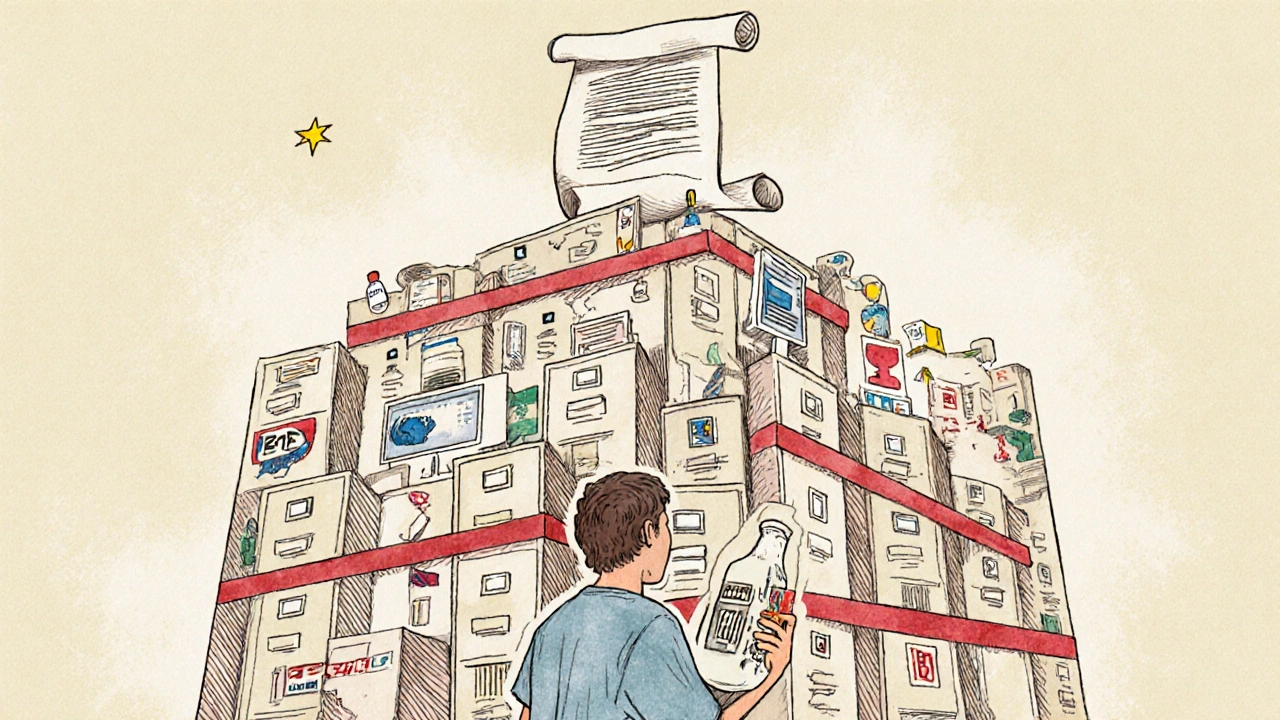

Formularies are lists of drugs your insurance plan agrees to cover, and they’re updated every year. Insurance companies build these lists to control costs and steer patients toward drugs they’ve negotiated lower prices for. But here’s the catch: just because a generic is on the market doesn’t mean it’s on your plan’s list. A 2023 IQVIA report found that 12.7% of all generic prescriptions faced formulary restrictions - up from 8.3% just five years ago. In autoimmune conditions like Crohn’s disease or rheumatoid arthritis, that number jumps to over 24%. The problem isn’t that these drugs are unsafe or ineffective. It’s that your insurer chose a different generic version - maybe one made by a company they have a rebate deal with - and now they’re refusing to pay for yours. Even though the active ingredient is the same, your plan treats them as different drugs. And if your doctor says you need this specific one because others caused side effects or didn’t work, you’re forced to fight for it.What you can do: the exceptions process

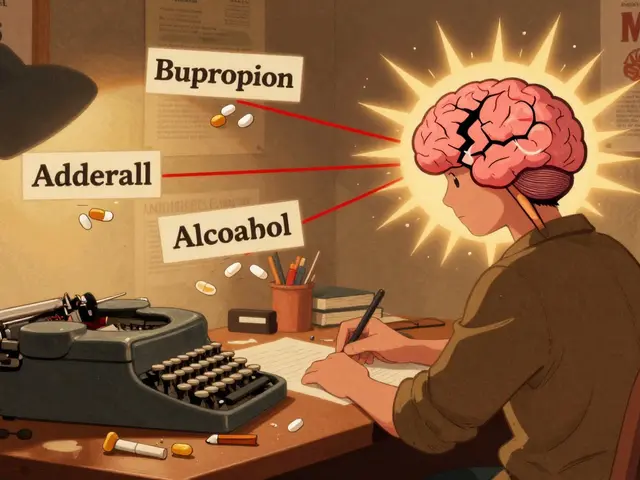

Federal law requires all Medicare Part D and most commercial plans to have a formal way to request coverage for non-formulary drugs. This is called an exceptions process, and it’s your legal right. You don’t have to pay out of pocket or go without medication. You can appeal - and many people do, successfully. The first step is simple: ask your pharmacy for a coverage determination. They’re required to give you a written denial within 24 hours. That document is your starting point. Don’t just accept the denial - use it. Next, your doctor must submit a formal request. This isn’t a quick note. The Centers for Medicare & Medicaid Services (CMS) requires the prescriber to explain why the non-formulary drug is necessary. That means more than saying “it works better.” You need specifics:- What formulary alternatives did you try, and when?

- What side effects did they cause? (e.g., “Switching from generic mesalamine to sulfasalazine caused severe nausea and vomiting”)

- What clinical data supports the need? (e.g., “Fecal calprotectin levels dropped from 850 to 120 on this specific formulation”)

- Why would switching harm you? (e.g., “Previous attempts to switch caused disease flare-ups requiring hospitalization”)

Urgent cases and emergency supplies

If you’re running out of medication and can’t wait 72 hours, you qualify for an expedited review. This applies if your condition could worsen without the drug - like diabetes, epilepsy, or heart failure. In these cases, the plan must respond within 24 hours. Even better: federal rules say you’re entitled to a 72-hour emergency supply while your request is being reviewed. But here’s what most people don’t know: 37% of plans ignore this rule, according to QuickRx’s 2023 compliance report. If your pharmacy says they can’t give you a temporary supply, ask for the plan’s exceptions department directly. Cite CMS guidelines. Most will comply when pressed.

What happens if you’re denied?

If your first request is denied, you don’t give up. You file an internal appeal. You have 60 days from the date of denial to do this. Your doctor can resubmit with more data - maybe lab results from the last six months, or a letter from a specialist. The Crohn’s & Colitis Foundation reports that 58% of initial denials are overturned on appeal. If the internal appeal fails, you can request an external review by an independent third party. This is a legal requirement, and it’s free. The process takes 14 to 21 days total from initial denial to final decision. According to CMS data, 68.4% of all non-formulary exception requests are approved at some stage - but only if you push through.Costs and hidden traps

Even if your exception is approved, there’s a catch. You can’t ask to move the drug to a lower cost-sharing tier. So even if they approve coverage, you might still pay $150 instead of $15. SmithRx found patients pay 3.7 times more for non-formulary generics than formulary ones - even when they’re the same chemical. And here’s something many patients miss: you can request a tiering exception separately. If your drug is approved for coverage but stuck on the highest tier, you can ask to move it down - but only if your doctor proves that lower-tier alternatives won’t work. Dr. Mark Parisi of MMIT says most providers don’t know this, so patients overpay by hundreds of dollars a month. A patient in Texas, ‘DiabetesWarrior,’ paid $417 for 90 days of generic metformin ER after a denial - even though the same drug costs $15 on formulary. After submitting A1c results showing improvement on that specific brand, their appeal was approved - but they had to fight for months.State differences matter

Medicare Part D follows federal rules, but commercial plans vary by state. Twenty-eight states have stronger rules than the federal minimum. California, for example, requires urgent requests to be decided in 48 hours - not 24. New York is pushing for 24-hour reviews for all non-urgent cases. If you’re on a commercial plan, check your state’s insurance department website. You might have more rights than you think.

What’s changing in 2025?

The system is slowly improving. In October 2023, CMS rolled out standardized clinical criteria for common conditions like diabetes, IBD, and epilepsy. This means doctors now have clearer guidelines on what evidence counts - and denials are dropping. CMS projects a 15-20% reduction in denials by 2025. The Inflation Reduction Act now requires automatic approval for certain generics like insulin and naloxone. No more appeals needed. And by 2025, CMS plans to integrate the exception process directly into electronic health records - cutting processing time by 40%. But challenges remain. Specialty pharmacies are increasingly carving out generics like bioidentical hormones, pushing them outside standard formularies. And with drug prices rising, insurers are tightening formularies even more.Real advice from real patients

On Reddit, a user named ‘PharmTechSarah’ spent four tries to get generic mesalamine approved. Each time, she added more detail: dates of flares, lab values, side effect logs. On the fourth try, they approved it. “It wasn’t luck,” she wrote. “It was documentation.” The GoodRx 2023 survey showed 63% of people who appealed got coverage - but only 29% knew they could ask for an expedited review. If you’re running out of pills, don’t wait. Call your plan. Say: “I need an urgent exception because I’m at risk of hospitalization.”What to do next

1. Get the denial in writing from the pharmacy. Don’t rely on verbal answers. 2. Call your doctor’s office and ask them to start the exceptions process. Offer to email them the CMS template. 3. Collect your medical records - especially lab results, previous prescriptions, and side effect logs. 4. Ask about emergency supply if you’re running out. Cite CMS rules. 5. File an appeal if denied. Use the 60-day window. Don’t wait. 6. Request a tiering exception separately if your drug is approved but still expensive. 7. Check your state’s rules - you might have faster timelines or better protections. This isn’t about fighting the system. It’s about using the rules that already exist. The system is designed to work - if you know how to use it.What is a non-formulary generic?

A non-formulary generic is a generic drug that’s FDA-approved and safe, but not listed on your insurance plan’s approved drug list. Even though it’s the same chemical as the covered version, your plan won’t pay for it unless you get an exception.

Can I still get a non-formulary generic if it’s denied?

Yes. Federal law requires insurers to have an exceptions process. You or your doctor can request coverage based on medical necessity. About 68% of these requests are approved at some stage, often after an appeal.

How long does the exceptions process take?

Standard requests take up to 72 business hours. If your condition could worsen without the drug, you can request an expedited review - the plan must respond in 24 hours. If you’re denied, you have 60 days to appeal internally, and then you can request an external review.

Why is my generic drug not covered when it’s cheaper?

Insurers choose which generics to cover based on contracts with manufacturers. Sometimes they get rebates for one version over another, even if they’re identical. It’s a business decision, not a medical one - but you have the right to appeal.

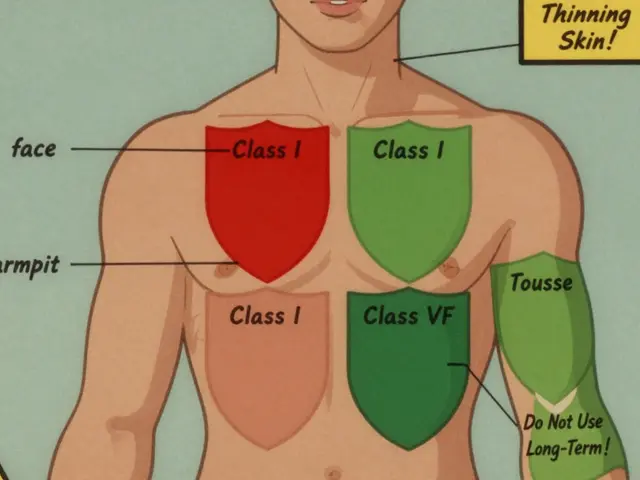

Can I switch to a different generic to avoid the denial?

You can, but only if it’s safe for you. If previous generics caused side effects or didn’t work, your doctor can document that in your exception request. Switching without medical reason could make your condition worse.

What if I can’t afford to pay out of pocket?

Many drug manufacturers offer patient assistance programs for non-formulary drugs. You can also check with nonprofits like NeedyMeds or the Patient Access Network Foundation. And remember - you can request a 72-hour emergency supply while your appeal is being reviewed.

Does this apply to Medicare Part D?

Yes. Medicare Part D plans are required by federal law to have an exceptions process for non-formulary drugs, including generics. The process is the same, and approval rates are high - especially for protected drug classes like anticonvulsants and insulin.

Can I get help filling out the forms?

Yes. Patient advocacy groups like the Crohn’s & Colitis Foundation and the National Organization for Rare Disorders offer free templates and guides. Your doctor’s office may also have a patient advocate on staff. Don’t try to do this alone - help is available.

10 Comments

Darrel Smith

November 27, 2025 at 03:43

They let insurance companies get away with this because we’re too lazy to fight back. I’ve seen people just give up and pay $400 for metformin when it’s $15 elsewhere - and they wonder why they’re broke. It’s not rocket science. You get the denial letter, you print the CMS template, you hand it to your doctor, and you call them every day until they cave. This isn’t a medical issue - it’s a moral failure. People are skipping doses because some suit in a corporate office decided to take a rebate from one generic manufacturer over another. Same chemical. Same pill. Same results. But hey, profits over people, right? I’m not mad. I’m just disappointed in all of us for letting this continue.

Aishwarya Sivaraj

November 27, 2025 at 11:17

i just want to say thank you for writing this. as someone from india where we dont have insurance but still struggle with drug pricing, this made me realize how broken systems are everywhere. even here, generics are often not available because pharma companies lock down distribution. i had a friend with crohns who spent 6 months trying to get the right mesalamine because the local pharmacy kept giving him a different brand that gave him stomach cramps. he finally got it after showing his stool test results. the system is cruel but your guide gives hope. i wish more doctors knew about the cms template. maybe we can translate this into hindi?

thank you again

Iives Perl

November 28, 2025 at 15:35

They’re hiding the real reason. It’s not rebates. It’s not ‘cost control.’ It’s the Big Pharma shadow government. The same companies that own the brand-name drugs own the formulary-approved generics. They make you pay full price for the ‘other’ generic so you’ll go back to the expensive brand. Watch the documentary ‘The Truth About Pills’ on YouTube - it’s deleted now but still archived. They’re playing us. And the FDA? Complicit. 72-hour emergency supply? They’ll deny it. Then you get sick. Then they bill you for the ER. It’s a trap. Don’t trust the system. Fight. Always fight.

steve stofelano, jr.

November 30, 2025 at 06:17

Thank you for this meticulously detailed and profoundly important exposition on the structural inequities embedded within pharmaceutical formulary management. The data presented - particularly the 68.4% approval rate across appeals - underscores the efficacy of procedural advocacy when executed with precision. I would respectfully suggest that healthcare providers consider integrating this workflow into standard patient discharge protocols, as the cognitive burden placed upon patients is disproportionate and ethically untenable. Furthermore, the reference to the Crohn’s & Colitis Foundation’s template constitutes an exemplary model of patient-centered care design. I shall distribute this document to my institution’s pharmacy and patient advocacy committee without delay.

Savakrit Singh

November 30, 2025 at 22:45

Let’s crunch the numbers properly 📊

12.7% non-formulary generics in 2023? That’s 1 in 8 prescriptions denied. Multiply that by 4B annual generic scripts in the US = 510M denied claims. At avg $150 out-of-pocket per denial = $76.5B in patient financial burden. And this doesn’t even account for downstream costs: ER visits, hospitalizations, lost productivity. 📉

Meanwhile, insurer profits rose 22% last year. 🤑

So yes - this is a $76.5B wealth transfer from sick people to shareholders. And the system is designed to make you feel guilty for asking for what’s yours. You’re not asking for luxury. You’re asking for your life to not be a commodity. #PharmaIsAMonopoly

Cecily Bogsprocket

December 1, 2025 at 12:17

I’ve been where you are. I spent 9 months fighting for my son’s epilepsy med. The first denial letter came in the mail on a Tuesday. I cried. Then I made a folder. I put in every lab result, every doctor’s note, every side effect log. I called the pharmacy every Thursday at 3 p.m. I didn’t yell. I didn’t beg. I just kept showing up with facts. On the 17th try, they approved it. Not because they changed their mind - because I made it too easy for them to say yes.

You’re not alone. And you’re not being difficult. You’re being brave. Keep going. One page of paperwork at a time. You’ve got this.

Jebari Lewis

December 2, 2025 at 16:21

Wait - you’re telling me that two identical pills, same active ingredient, same dosage, same manufacturer, are treated as different drugs by insurers? That’s not just bureaucratic nonsense - that’s scientific fraud. If two substances are chemically indistinguishable, they are the same substance. Period. The fact that insurance companies can legally classify them as different is a loophole that should be shut down by Congress. And why isn’t the AMA screaming about this? Why are medical associations silent? This isn’t just a patient issue - it’s a betrayal of medical ethics. I’m filing a complaint with the AMA ethics board today. Someone needs to hold these people accountable.

Emma louise

December 4, 2025 at 01:32

Oh no, the poor patients have to fight for their $15 generic. 😱

Maybe if they didn’t have so many chronic conditions they wouldn’t need so many drugs? Just saying. Also, I heard the government pays for half of all prescriptions - so really, it’s your tax dollars paying for this. Maybe we should just stop giving people medicine and let them tough it out like in the 1950s. No insurance? No problem. Just pray and take aspirin.

sharicka holloway

December 4, 2025 at 21:37

Thank you for this. I shared it with my sister who’s on Medicaid and was just told her generic seizure med wasn’t covered. She was about to quit. Now she’s printing the CMS template and calling her doctor tomorrow. You didn’t just write an article - you gave someone hope. That’s more than most do. Keep speaking up. We’re listening.

Alex Hess

December 6, 2025 at 17:12

This is why America is collapsing. People don’t want to work - they want the government to force insurers to pay for their pills. If you can’t afford a $15 generic, maybe you shouldn’t have taken the drug in the first place. This isn’t a healthcare crisis - it’s a personal responsibility crisis. Stop whining. Get a job. Or don’t take the pill. Simple.