Indian Generic Manufacturers: The World's Pharmacy and Exports

When you take a pill for high blood pressure, diabetes, or an infection, there’s a good chance it came from India. Not because it’s made in a lab in New York or Zurich, but because factories in Ahmedabad, Hyderabad, or Mumbai produced it for a fraction of the cost. India doesn’t just make generic drugs - it powers the global supply of affordable medicine. It’s not hype. It’s fact. The country supplies 20% of all pharmaceuticals exported worldwide by volume, more than any other nation. And for billions of people, especially in low-income countries, that means the difference between life and death.

How India Became the Pharmacy of the World

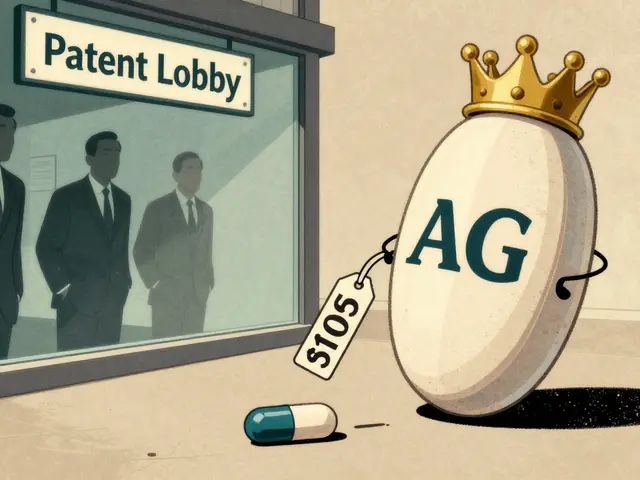

India’s rise wasn’t accidental. It started with a bold legal move in the 1970s. Back then, most countries protected drug patents, meaning only the original company could make a medicine for 20 years. That kept prices high. India changed the rules. In 1970, it passed a new Patents Act that allowed local companies to copy patented drugs as long as they used a different manufacturing process. No product patents - only process patents. That opened the floodgates. Suddenly, Indian manufacturers could reverse-engineer life-saving drugs like antibiotics, antivirals, and heart medications and sell them at 80% less than the branded versions. This wasn’t just about saving money. It was about access. When HIV/AIDS hit Africa in the 1990s, the treatment cost $10,000 a year per patient. Indian companies like Cipla started making the same drugs for $100. That single shift saved millions of lives. The world took notice. By the 2000s, India was exporting generics to over 150 countries. Today, it’s the largest vaccine producer on Earth, making more than 60% of the world’s vaccines - including the ones used in global immunization programs.The Numbers Behind the Powerhouse

The scale is staggering. India has over 10,000 drug manufacturing units and more than 3,000 pharmaceutical companies. But what makes it truly unique is the quality. More than 650 of these plants are approved by the U.S. Food and Drug Administration (FDA) - the highest number outside the United States. Another 2,000 meet WHO-GMP standards. That’s not a small feat. Getting FDA approval is brutal. Inspectors show up unannounced. They check every step - from raw materials to packaging. Most companies fail their first attempt. Indian firms, though, have improved dramatically. Compliance rates jumped from 60% in 2015 to 85-90% today. In 2023-24, India’s pharmaceutical industry was worth $50 billion. By 2030, it’s expected to hit $130 billion. And exports? They’re growing fast. India supplies 40% of all generic drugs used in the U.S., 33% of those in the UK, and nearly half of all medicines in Sub-Saharan Africa. It’s not just pills. It’s syringes, patches, inhalers, and injectables. Indian manufacturers now produce over 60,000 generic medicines and 500 active pharmaceutical ingredients (APIs). That’s more than any other country.Who’s Making the Drugs?

It’s not just small players. India’s market is led by giants. Sun Pharma, with a market value of over $43 billion, is the largest generic drugmaker in the world. Cipla and Dr. Reddy’s aren’t far behind, each worth more than $10 billion. These companies don’t just copy old drugs anymore. They’re investing heavily in complex generics - things like extended-release tablets that last 12 hours, transdermal patches for chronic pain, and sterile injectables for cancer patients. Sun Pharma spends 6-8% of its revenue on R&D. Biocon, a biotech leader, is pouring over $500 million a year into biosimilars - cheaper versions of expensive biologic drugs like Humira and Enbrel. These companies don’t work in isolation. They’re part of a tightly woven ecosystem. There are API suppliers, packaging firms, logistics providers, and testing labs. Together, they’ve built an infrastructure that can churn out billions of doses at a time. During the pandemic, India shipped over 600 million doses of COVID vaccines to more than 90 countries. No other country could have done that at that scale and speed.

Why India Beats the Competition

China makes more APIs - the raw ingredients in drugs - but it doesn’t have the same regulatory track record. The U.S. FDA has approved only 153 plants in China compared to India’s 650. That’s why Western countries trust Indian manufacturers more. European generics like Teva and Sandoz charge higher prices and focus on niche markets. India dominates volume. It’s the go-to for high-volume, low-margin drugs that keep public health systems running. The cost advantage is real. Indian generics are typically 30-80% cheaper than branded drugs. In the U.S., where nine out of ten prescriptions are for generics, Indian-made versions make up 40% of the market. Patients save hundreds, sometimes thousands, per year. In India itself, the domestic generic market is worth $28 billion and is expected to grow to over $50 billion by 2033. But here’s the catch: India earns far less per pill than it could. It makes up only 10% of the global generics market by value, even though it supplies 20% by volume. Why? Because it sells mostly low-cost, off-patent drugs. The big money is in high-value products - biosimilars, complex injectables, specialty therapies. That’s where India is now trying to shift.The Hidden Weakness: Dependence on China

Despite all its strengths, India has one big vulnerability: it relies on China for 70% of its active pharmaceutical ingredients. That’s a problem. When China shut down during COVID, or when geopolitical tensions rose, drug shortages followed. The Indian government knows this. That’s why it launched a $400 million Production Linked Incentive (PLI) scheme to boost domestic API production. The goal? To cut China’s share to 30% by 2026. So far, progress is slow. Building API plants takes years. The capital cost is high - $50-100 million per facility. And the technical know-how isn’t easy to replicate. Still, there’s momentum. Companies like Aurobindo and Divi’s Laboratories are expanding their API capacity. New plants are coming online. The hope is that by 2030, India won’t just be the world’s pharmacy - it’ll also be its own source of raw materials.

Quality Concerns and Real-World Challenges

No system is perfect. There have been scandals. In 2025, The Bureau of Investigative Journalism reported cases of dangerous drugs from Indian factories ending up in the U.S. and Europe. These weren’t common. But they happened. FDA warning letters in 2023 showed that 22% of inspection issues came from translation errors in paperwork - not the drugs themselves, but the documents. Packaging inconsistencies and shipping delays also rank high in customer complaints, especially on platforms like Trustpilot. In the U.S., some patients reported inconsistent effects from Indian-made levothyroxine - a thyroid drug. One Reddit thread with 147 upvotes detailed how different batches seemed to work differently. The FDA investigated. The issue? Dissolution rates - how fast the drug dissolves in the body. It’s a technical problem, not a safety one. The drug wasn’t harmful. But it wasn’t working as consistently as it should. The truth? Most Indian generics are safe and effective. A 2024 survey by PharmacyChecker.com found 87% of U.S. users were satisfied. In Africa, Doctors Without Borders reported 95% efficacy for Indian-made antimalarials. The NHS in the UK gives Indian generics a 4.2/5 satisfaction rating. The complaints are real, but they’re outliers - not the norm.The Future: From Volume to Value

India’s next chapter isn’t about making more pills. It’s about making better ones. The government’s Pharma Vision 2047 aims for $190 billion in exports - not by selling cheap tablets, but by leading in biosimilars, gene therapies, and complex drug delivery systems. Companies are already moving in that direction. Biocon’s biosimilars are now sold in the EU and U.S. Dr. Reddy’s is developing inhalable insulin. Sun Pharma is testing new cancer drugs. The shift won’t be easy. It takes billions in R&D. It takes regulatory expertise. It takes patience. But the signs are there. India now leads the world in biosimilar approvals. It’s the only country that can produce high-quality, low-cost drugs at scale. That’s a rare combination. If India can solve its API dependency, improve its regulatory consistency, and move up the value chain, it won’t just be the pharmacy of the world. It could become the engine of global innovation in medicine.Are Indian generic drugs safe?

Yes, the vast majority are. Over 650 Indian drug factories are approved by the U.S. FDA, and more than 2,000 meet WHO-GMP standards. Compliance rates have jumped from 60% in 2015 to 85-90% today. While there have been isolated cases of quality issues - like inconsistent dissolution rates in some batches - these are rare. Most Indian generics are clinically equivalent to brand-name drugs and are used safely by millions worldwide.

Why are Indian generic drugs so cheap?

India eliminated product patents in 1970, allowing local companies to copy patented drugs without paying royalties. That, combined with lower labor and production costs, lets them make high-quality medicines at 30-80% less than Western manufacturers. They focus on volume, not premium pricing, making drugs affordable for public health systems and low-income patients.

Does the U.S. rely on Indian generic drugs?

Yes. India supplies about 40% of all generic drugs dispensed in the U.S., making it the largest foreign supplier. That includes common medications like metformin, lisinopril, and amoxicillin. Without Indian generics, U.S. drug prices would be significantly higher, especially for patients without insurance.

How does India compare to China in drug manufacturing?

China produces more active pharmaceutical ingredients (APIs) and at lower costs, but India has far stronger regulatory compliance. The U.S. FDA has approved 650 manufacturing plants in India versus only 153 in China. That’s why Western countries trust Indian factories more for finished drugs, even if China supplies the raw materials. India’s strength is in quality-controlled final products; China’s is in bulk chemical production.

What’s the biggest challenge facing Indian generic manufacturers today?

Their dependence on China for 70% of active pharmaceutical ingredients (APIs). This creates supply chain risks, as seen during the pandemic. The Indian government is investing $400 million to fix this through the PLI scheme, aiming for 53% API self-sufficiency by 2026. Another major challenge is moving from low-cost volume production to high-value products like biosimilars and complex drug formulations.

Can Indian companies compete with big pharma on innovation?

They’re trying. While Western giants focus on new chemical entities, Indian firms like Biocon, Dr. Reddy’s, and Sun Pharma are investing heavily in biosimilars - cheaper versions of biologic drugs that cost millions to develop. These are complex, high-margin products. India is now the global leader in biosimilar approvals. It’s not catching up to Pfizer or Roche on new drug discovery yet, but it’s becoming a powerhouse in bringing advanced therapies to market affordably.

9 Comments

Rebecca M.

December 3, 2025 at 08:24

Oh wow, India’s the pharmacy of the world? Guess that’s why my $3 metformin tastes like chalk and my blood pressure still spikes. 🤡

Lynn Steiner

December 5, 2025 at 06:40

They’re not just making drugs-they’re making OUR lives cheaper. And you know what? I’d rather pay $5 for a pill that works than $500 for a brand that just looks fancy. 🇮🇳💪

Arun kumar

December 5, 2025 at 15:57

Man, i remember when my dad got his heart med from hyderabad-cost like 10 bucks, worked better than the usa one. people act like generics are junk but nah, its just capitalism that made us think expensive = better. india just did the right thing: make medicine for people, not profit. 🙏

मनोज कुमार

December 6, 2025 at 09:02

API dependency on china is the Achilles heel. PLI scheme is theater. Capital expenditure >50M per plant. Regulatory compliance improved but QA still inconsistent. Volume yes. Value no. Biosimilars are the future but R&D lagging. End of story.

dave nevogt

December 7, 2025 at 17:27

It’s fascinating how India turned a legal loophole into a humanitarian lifeline. The 1970 Patents Act wasn’t just policy-it was an ethical stance against medical colonialism. While Western pharma built empires on exclusivity, India built bridges with affordability. The real tragedy isn’t the dependence on Chinese APIs-it’s that the world still treats medicine as a commodity instead of a right. And now, as India tries to climb the value chain, it’s not just competing with corporations-it’s trying to rewrite the rules of global health equity. That’s not just business. That’s legacy.

Zed theMartian

December 8, 2025 at 22:36

Oh please. India’s ‘pharmacy’ is just a dumping ground for substandard pills that the FDA barely tolerates. 22% of warning letters are from translation errors? That’s not compliance-that’s negligence dressed up as ‘cost efficiency.’ And don’t get me started on the 600M vaccine doses shipped during COVID-most were expired by the time they landed. 🤦♂️

Alicia Marks

December 10, 2025 at 07:41

You’re doing amazing work. Keep going. The world needs more of this.

Ella van Rij

December 10, 2025 at 09:36

Wait… so India makes 40% of US generics but only 10% of the *value*? That’s like selling gold as gravel. Someone’s making bank and it ain’t the guys in Ahmedabad. 😒

Jack Dao

December 10, 2025 at 12:58

Let’s be real-India’s ‘success’ is built on stealing IP, exploiting labor, and outsourcing quality control to a country that can’t even spell ‘GMP’ correctly. Meanwhile, we’re paying $1000 for insulin while they export $2 versions. This isn’t innovation. It’s exploitation dressed in saris and slogans. 🤨