Formulary Tiers: How Insurance Decides What Drugs You Can Afford

When your insurance says formulary tiers, a system that groups medications by cost and coverage level. Also known as drug tiers, it determines whether you pay $5, $50, or $500 for the same pill. This isn’t about drug quality—it’s about money. Your plan puts cheaper generics in Tier 1 and expensive brand-name drugs in Tier 4 or 5, and that’s where your out-of-pocket cost jumps. If your medication isn’t on the formulary at all, you’re stuck with the full price unless you fight back.

Many people don’t realize that non-formulary generics, generic drugs your insurer refuses to cover even though they’re cheap and safe are a common trap. Just because a drug is generic doesn’t mean it’s on the list. This happens when insurers partner with specific manufacturers or when a drug hasn’t been reviewed yet. But you’re not powerless. Federal rules let you appeal these denials, and many people succeed with a simple letter from their doctor explaining why the drug is medically necessary. Medicare Part D, the prescription drug plan for seniors has a formal process for this, and state laws often add extra protections.

Formulary tiers also explain why your doctor might switch your medication. A drug you’ve been on for years could suddenly move to a higher tier, making it unaffordable. That’s not a mistake—it’s a cost-control tactic. Insurers push patients toward cheaper alternatives, even if the change isn’t always easy. For drugs like warfarin or levothyroxine, switching generics can require dose adjustments, and insurers rarely warn you about it. That’s why knowing your tier status matters. If your drug gets bumped up, ask your pharmacist for the tier number and check your plan’s formulary online. You might find a similar drug in a lower tier that works just as well.

Some drugs are blocked entirely because they’re considered "experimental," "not cost-effective," or "too risky." But what’s risky to an insurer might be life-saving to you. That’s where drug cost tiers, the specific levels that determine your copay become a battleground. If you’re on a high-cost medication for a chronic condition, you’re likely hitting the "specialty tier," where you pay 30% or more of the price. These drugs often include biologics, cancer treatments, or rare disease therapies. The good news? Many manufacturers offer patient assistance programs, and some states have laws that cap out-of-pocket spending on these drugs.

What you’ll find below are real stories and practical steps from people who’ve been through this. You’ll learn how to read your formulary like a pro, how to get a non-formulary drug approved, why some combination blood pressure pills are denied even when they’re cheaper than buying two separate pills, and what to say when your pharmacy says "it’s not covered." These aren’t theoretical guides—they’re battle-tested strategies from patients who fought the system and won.

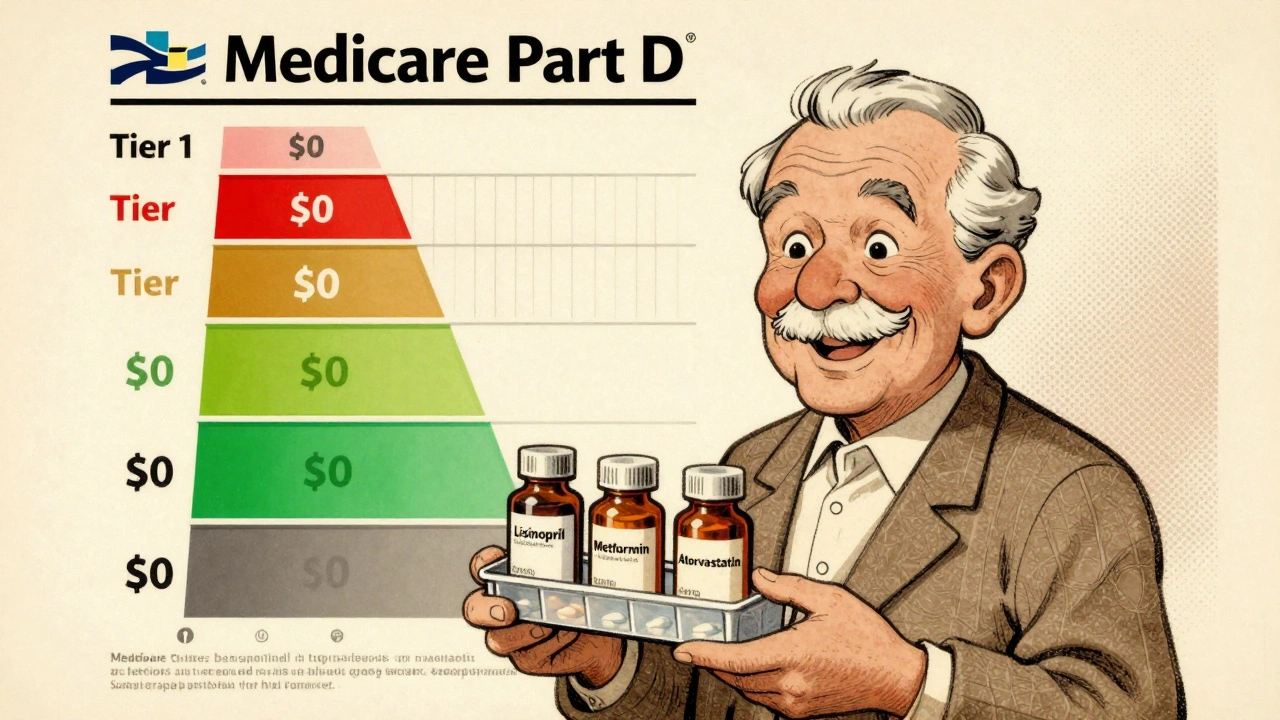

Medicare Part D Formularies: How Generic Coverage Works in 2025

Learn how Medicare Part D covers generic drugs in 2025 - including tiered costs, the $2,000 out-of-pocket cap, and how to save money on your prescriptions.

Read More