Generic Drug Coverage: What Insurance Really Pays For and When It Doesn’t

When you hear generic drug coverage, the extent to which health insurance plans reimburse for brand-name equivalents that are chemically identical. Also known as formulary coverage, it’s not just about saving money—it’s about whether your plan actually lets you use those savings. Many people assume that if a drug is generic, insurance will automatically cover it. That’s not true. Insurance companies have lists called formularies, and even if a generic is FDA-approved, it might not be on the list—or it might be placed in a higher cost tier than the brand name.

Why does this happen? It often comes down to NTI drugs, narrow therapeutic index medications where tiny differences in dosage can cause serious harm or treatment failure. Examples include warfarin, levothyroxine, and phenytoin. Even though generics are supposed to be equivalent, insurers sometimes restrict these because switching between brands can trigger dangerous side effects. Some plans require prior authorization before covering any generic version of these drugs, or they’ll only pay for one specific manufacturer’s version.

Then there’s the issue of prescription costs, what you pay out of pocket after insurance applies its rules. Even with coverage, high-deductible plans can make generics expensive before you hit your deductible. And some insurers use step therapy—you have to try a cheaper generic first, even if your doctor says it won’t work for you. Meanwhile, combination pills like antihypertensive combination generics are often excluded because they’re seen as "convenience drugs," even though they simplify regimens and improve adherence.

What you’re really dealing with isn’t just a drug—it’s a system. The same generic pill might be covered in full under one plan, denied under another, or require paperwork just to get a 30-day supply. And if you’re on multiple meds, like immunosuppressants after a transplant or diabetes drugs with joint pain risks, the complexity multiplies. Your pharmacist might switch your generic without telling you, and if you’re on an NTI drug, that switch could change how you feel—or put you in the hospital.

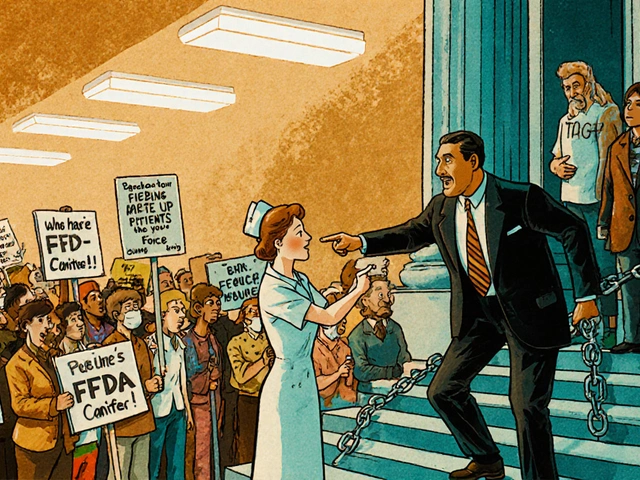

This collection of posts cuts through the noise. You’ll find real-world stories of people who had to fight their insurer for a specific generic, guides on how to check if your plan covers a drug before you fill it, and what to say when your pharmacy says "it’s not covered" but the doctor insists. We’ll show you how to read your formulary, when to appeal a denial, and why some generics are treated like luxury items even though they cost pennies. You’ll also learn how to spot when a switch is risky, how to ask your doctor for a prior authorization, and what alternatives exist if your insurance won’t budge.

Non-formulary generics: what to do when coverage is denied

When your insurance denies coverage for a generic drug, you’re not out of options. Learn how to appeal non-formulary generic denials using federal exceptions processes, clinical documentation, and state-specific rights to get the medication you need.

Read More