Medicare Part D: What It Covers, How to Appeal Denials, and What You Pay

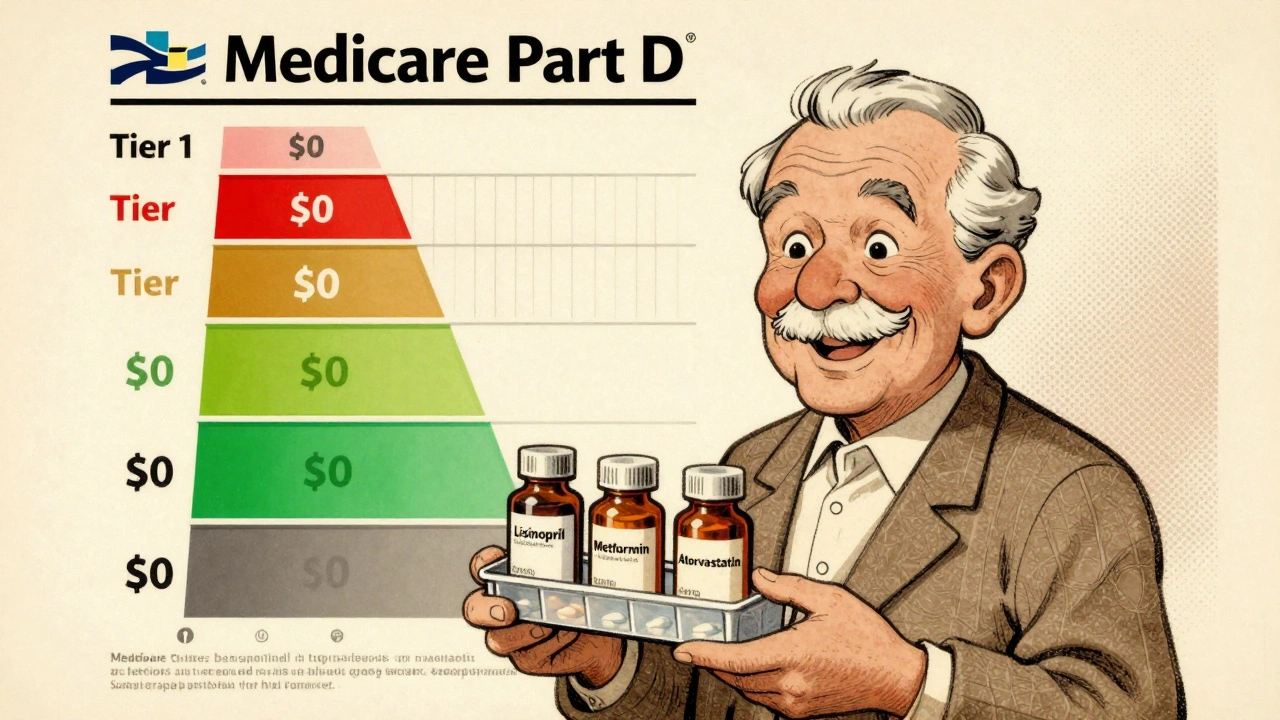

When you enroll in Medicare Part D, the federal program that helps pay for prescription drugs for people on Medicare. Also known as Medicare prescription drug coverage, it’s not automatic—you have to pick a plan, and not all drugs are covered the same way. Many people assume their Part D plan covers everything, but that’s not true. Plans have lists called formularies, and if your drug isn’t on it, you might get denied—no matter how essential it is.

That’s where non-formulary generics, generic drugs not included in your plan’s approved list. Also known as off-formulary medications, they’re often cheaper but still denied coverage come in. If your doctor prescribes a generic that’s not on your plan’s list, you don’t just have to pay full price. You can appeal. Federal rules let you request exceptions based on medical need, and many people win these appeals with the right documentation. It’s not magic—it’s a process, and it works if you know how to use it.

Then there’s the cost. Medicare drug negotiations, a new rule letting Medicare haggle directly with drugmakers for lower prices. Also known as Medicare price bargaining, it’s just starting to take effect. Before this, the U.S. paid way more than other countries for the same brand-name drugs. Now, for a handful of high-cost medications, prices are finally dropping. But that doesn’t mean your monthly premium or copay dropped too. Many plans still shift costs around—higher deductibles, tiered copays, step therapy. You might get a cheaper drug, but only after trying three others first.

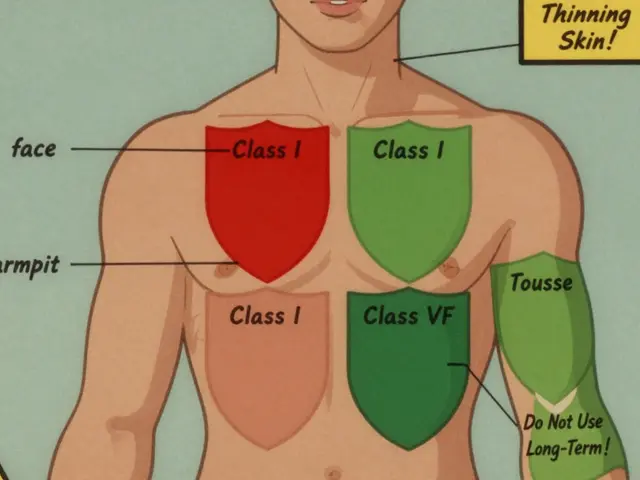

And if you’re on a drug like warfarin or levothyroxine, switching to a generic isn’t always simple. Even small changes in how a generic is made can affect how your body absorbs it. That’s why some doctors adjust doses after switching—and why you need to know when to ask for it. Medicare Part D plans don’t always warn you about these risks. You have to watch for changes in how you feel, track your labs, and speak up.

What you’ll find below isn’t theory. It’s real advice from people who’ve fought insurance denials, figured out why their insulin cost $500, and learned how to get a combo blood pressure pill covered when the plan said no. You’ll see how to read your plan’s formulary, what to say when you call customer service, and which drugs are most likely to be denied—even if they’re generic. You’ll also find out why Indian-made generics are suddenly showing up in U.S. pharmacies, and how expiration dates on your meds can quietly affect your coverage.

Medicare Part D Formularies: How Generic Coverage Works in 2025

Learn how Medicare Part D covers generic drugs in 2025 - including tiered costs, the $2,000 out-of-pocket cap, and how to save money on your prescriptions.

Read More