Part D Costs: What You Really Pay for Medicare Drug Coverage

When you enroll in Medicare Part D, the federal program that helps pay for prescription drugs. Also known as Medicare drug coverage, it’s not free—and what you pay depends on your plan, income, and which drugs you take. Many assume Part D just means a monthly premium, but that’s only the start. There’s also the deductible, copays, coinsurance, and the infamous coverage gap—better known as the donut hole. And if your income is above a certain level, you pay an extra charge on top of your plan’s premium. The truth? You could be paying hundreds more a year than you think.

Part D costs aren’t the same for everyone. A low-income beneficiary might pay almost nothing thanks to Extra Help, while someone earning over $100,000 a year could pay over $80 extra per month just because of income-related adjustments. And it’s not just about the price tag on the bottle. Some plans cover your meds better than others, even if the premium is higher. A plan with a $30 monthly fee might save you $200 a month on your insulin, while a $10 plan could leave you paying $400 out of pocket for the same drug. It’s not about the cheapest plan—it’s about the plan that works for your drugs.

Drug formularies change every year. A medication covered in January might be moved to a higher tier in July, forcing you to pay more. And if your doctor switches you to a generic, you might still face a surprise cost if the generic isn’t on your plan’s preferred list. That’s where non-formulary generics, generic drugs your plan doesn’t automatically cover. Also known as non-preferred generics, they often require an appeal or prior authorization. You’re not stuck—federal rules let you request exceptions, and many people get them approved with a simple letter from their doctor. Then there’s the coverage gap. Once you and your plan have spent a certain amount on drugs, you pay a higher share—until you hit the catastrophic threshold. But here’s the thing: you don’t have to pay 100% in the gap anymore. Thanks to recent changes, you pay only 25% of the cost for both brand-name and generic drugs while in the donut hole.

What you pay for your meds isn’t just about the plan you picked. It’s tied to Medicare drug negotiations, a new federal process that lets Medicare bargain directly with drugmakers for lower prices. Also known as Medicare price-setting, this is starting to bring down costs for high-priced drugs like insulin and blood thinners—but only for those on specific plans that include the negotiated prices. If you take one of these drugs, check your plan’s formulary every fall during Open Enrollment. A new plan might now cover your medication at a fraction of the cost.

And don’t forget the hidden costs: missed doses because you couldn’t afford your pills, emergency visits from skipped medications, or switching to a cheaper drug that doesn’t work as well. Part D isn’t just about paying for prescriptions—it’s about keeping you healthy enough to avoid far costlier problems down the line. The goal isn’t to find the lowest premium. It’s to find the plan that keeps your meds affordable, your health stable, and your out-of-pocket costs predictable.

Below, you’ll find real stories and practical guides on how people cut their Part D costs—whether it’s appealing a denied drug, switching to a cheaper generic, understanding the donut hole, or getting help through government programs. No fluff. No jargon. Just what works.

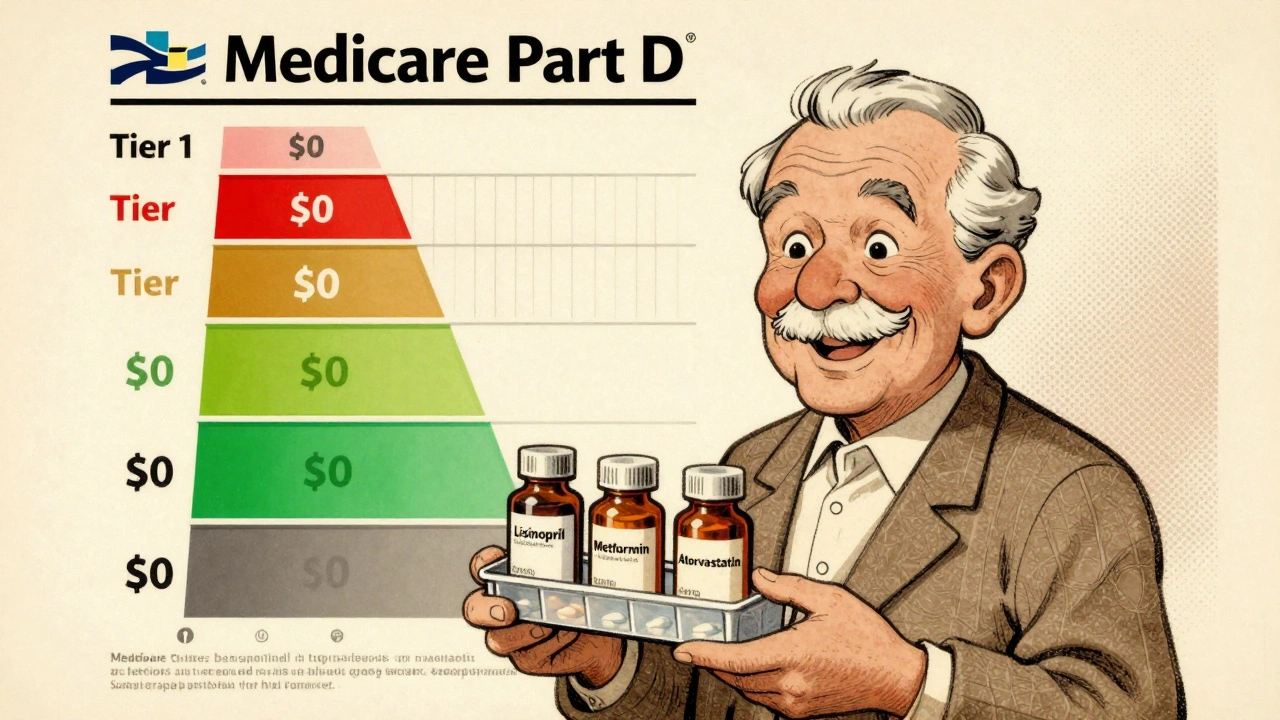

Medicare Part D Formularies: How Generic Coverage Works in 2025

Learn how Medicare Part D covers generic drugs in 2025 - including tiered costs, the $2,000 out-of-pocket cap, and how to save money on your prescriptions.

Read More